Representing Buyer and Seller, Luzon Leverages His Vast Experience to Help Secure a Very Complex Commercial Real Estate Transaction.

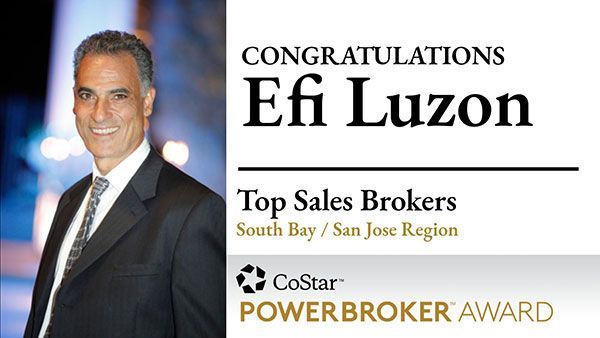

CUPERTINO, Calif., September 19, 2022–(BUSINESS WIRE)–Intero, a Berkshire Hathaway affiliate and wholly owned subsidiary of HomeServices of America, Inc., is pleased to announce that Efi Luzon, Head of Intero Capital Markets, has closed a $55 million transaction in Saratoga, Calif.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220919005660/en/

https://finance.yahoo.com/news/efi-luzon-continues-successful-career-160300453.html?.tsrc=fin-srch

The sale, which was between Pulte Homes, one of America’s largest homebuilding companies, and Sand Hill Property Company, the most reputable and noteworthy real estate investment and development firm in Silicon Valley, was brokered for both sides by Luzon. The 6.3-acre site is located at 18764 Cox Avenue in Saratoga, Calif. and is the site of Sand Hill’s proposed Quito Village, which the city of Saratoga approved in April of 2020.

“Some real estate transactions are more complex and take specific experience that only a few have,” said Efi Luzon, Head of Intero Capital Markets. “I am proud to have used my expertise and connections to make sure this transaction closed to the satisfaction of both parties involved.”

Luzon started with Intero in 2004 and has had a stellar career with the firm. In that 18-year timeframe, Luzon has closed over $7 billion in sales volume and has helped broker some of the most iconic real estate transactions in the country including Sand Hill’s $250 million acquisition of the I. Magnin building in San Francisco’s historic Union Square and Sand Hill’s acquisition of the 1.3-million-square foot Vallco Shopping Mall in Cupertino, Calif for $320 million. A consistent top-producer, Luzon earned the most coveted award from Intero with his induction into the Hall of Fame in 2015.

In 2019, Luzon became the Head of Intero Capital Markets, a national investment sales platform. Under his leadership, the Intero Capital Markets Division is expanding and revolutionizing commercial development with superior knowledge and connections. A prime example is Luzon and his team working with Sand Hill Property Company and their acquisition of the Vallco Shopping Mall in Cupertino. Sand Hill Property Company is renaming Vallco to The Rise, which will be metamorphosed into an imaginative seven-million square foot development.

This project has been years in the making and has been designed with vast amounts of community input to provide an iconic, cutting-edge town center at the heart of the city renowned for design and technology and the birthplace of Apple. When Luzon brokered the original deal for Peter Pau, Principal & Co-Founder of Sand Hill Property Company, to purchase the land where The Rise will be located, he leveraged his years of experience to layout his vision of what the land could become. There was a synergy between Luzon and Pau that this particular project is fated to become an international destination and one that will be a renowned chapter in the book of commercial development. Luzon’s firm, Intero and an affiliate team will continue to play a key role in supporting all marketing and sales activities of all residential components for this incredible development.

“We are proud of Efi’s consistency at the highest levels of performance in our industry,” said Brian Crane, Chief Executive Officer of Intero. “His accomplishments and success in the Capital Markets space solidify Efi as one of the top brokers in the industry. His continued growth and success are a reflection of the knowledge and expertise he brings to his clients in these complex transactions. I look forward to Efi’s continued success.”

Intero, a Berkshire Hathaway affiliate and wholly owned subsidiary of HomeServices of America Inc., serves Northern California and Nevada with 21 offices throughout the greater Silicon Valley, San Francisco, Calaveras County, Western Nevada, and the Greater Lake Tahoe Region. The Intero Franchise network comprises 34 affiliates located in California, Nevada, Tennessee, and Texas. The company is headquartered in the heart of California’s Silicon Valley.

Find more information about Intero at www.intero.com. Find more information about HomeServices of America at www.homeservices.com.

View source version on:

https://finance.yahoo.com/news/efi-luzon-continues-successful-career-160300453.html?.tsrc=fin-srch